UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

We make things work for you.

| 2014 | ||

| PSEG | ||

| Proxy | ||

| Statement |

Public Service Enterprise Group Incorporated

80 Park Plaza, P.O. Box 1171, Newark, New Jersey 07101-1171

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 16, 2013

AND

PROXY STATEMENT

To the Stockholders of Public Service Enterprise Group Incorporated:

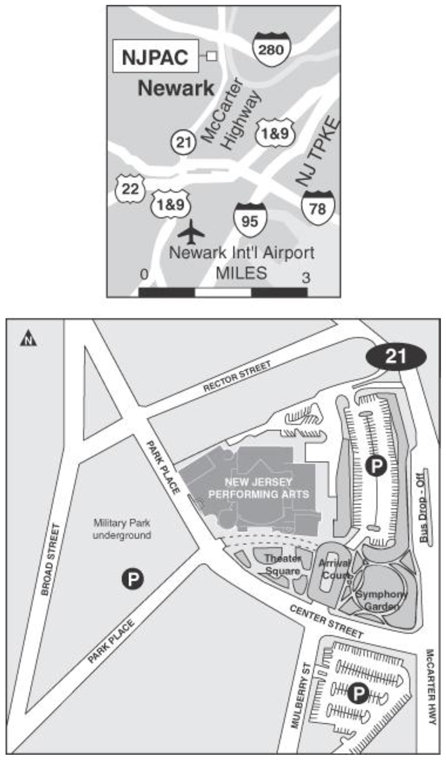

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Public Service Enterprise Group Incorporated will be held at the New Jersey Performing Arts Center, One Center Street, Newark, New Jersey, on April 16, 2013, at 1:00 P.M., for the following purposes:

| Date | April 15, 2014 at 1:00 P.M. | |||

| Location | The New Jersey Performing Arts Center One Center Street Newark, New Jersey 07102 | |||

| Items of Business | 1. | Elect ten members of the Board of Directors to hold office until the Annual Meeting of Stockholders in | ||

| 2. | Consider and act upon an advisory vote on the approval of executive compensation; |

| 3. | Consider and act upon |

| 4. |

Consider and act upon the ratification of the appointment of Deloitte & Touche LLP as independent auditor for |

5.

| Transact such other business as may properly come before the meeting or any adjournment or postponement thereof. | ||||

| Record Date | Stockholders entitled to vote at the meeting are the holders of Common Stock of record on February 14, 2014. | |||

Stockholders entitled to vote at the meeting are the holders of Common Stock of record on February 15, 2013.

By order of the Board of Directors,

| Scan thisQR Code to view the 2014 PSEG Proxy Statement and Annual Report on your mobile device. | By order of the Board of Directors, | ||||

| ||||||

M. Courtney McCormick Secretary March 3, 2014 |

M. Courtney McCormick

Secretary

February 27, 2013

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

to be Held on April 16, 2013:15, 2014: The Proxy Statement and Annual Report to Stockholders are available at

www.ezodproxy.com/pseg/2013/pseg2012ar2014/pseg2013ar

IMPORTANT! YOUR VOTE IS YOU MAY HAVE MULTIPLE ACCOUNTS AND THEREFOR RECEIVE MORE THAN ONE PROXY CARD OR VOTING INSTRUCTION FORM AND RELATED MATERIALS. PLEASE VOTE EACH PROXY CARD AND VOTING INSTRUCTION FORM THAT YOU RECEIVE. THANK YOU FOR VOTING. |

The approximate date on which this Proxy Statement and the accompanying proxy card were first sent or given to security holders and made available electronically via the Internet was March 8, 2013.10, 2014.

TABLE OF CONTENTS

TABLE OF CONTENTS

| TABLE OF CONTENTS |

PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement

TABLE OF CONTENTS

TABLE OF CONTENTS

| ||||||

| 53 | |||||

| 55 | |||||

PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement

| TABLE OF CONTENTS |

Forward-Looking Statements

The statements contained in this Proxy Statement about usour and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical, are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Although we believe that our expectations are based on information currently available and on reasonable assumptions, we can give no assurance they will be achieved. There are a number of risks and uncertainties that could cause actual results to differ materially from theany forward-looking statements made herein. A discussion of some of these risks and uncertainties is contained in our Annual Report on Form 10-K and subsequent reports on Form 10-Q and Form 8-K filed with the Securities and Exchange Commission (SEC), and available on our website:http://www.pseg.com. These documentsreports address in further detail our business, industry issues and other factors that could cause actual results to differ materially from those indicated in this Proxy Statement. In addition, any forward-looking statements included herein represent our estimates only as of the date hereof and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if our internal estimates change, unless otherwise required by applicable securities laws.

PUBLIC SERVICE ENTERPRISE GROUP |l20132014 Proxy Statement

| PROXY STATEMENT SUMMARY |

PROXY STATEMENT SUMMARY

PROXY STATEMENT SUMMARY

OUR COMPANY

Public Service Enterprise Group Incorporated (we, us, our, PSEG or the Company) is distributing this Proxy Statement in connection with our 20132014 Annual Meeting of Stockholders. We are a holding company that directly owns fourfive subsidiaries:

|

|

|

PSEG Energy Holdings L.L.C. (Energy Holdings), an owner of energy-related investments; and PSEG Services Corporation (Services), which provides management and administrative services to us and our subsidiaries.

|

ANNUAL MEETING PROPOSALS

| Proposals | Proposals | Board Recommendation | Page Number for More Information | Proposals | Board Recommendation | Page Number for More Information | ||||||||||||

1. |

Election of Directors – vote to elect director nominees to serve one-year terms. |

FOR |

8 | Election of Directors –vote to elect ten director nominees to serve one-year terms.

| FOR | 9 | ||||||||||||

2. |

Approval of Executive Compensation – advisory vote to approve the executive compensation of the named executive officers. |

FOR |

30 | Approval of Executive Compensation –advisory vote to approve the executive compensation of the named executive officers.

| FOR | 32 | ||||||||||||

3. |

2004 Long-Term Incentive Plan – approve proposed amendment and restatement of our 2004 Long-Term Incentive Plan. |

FOR |

68 | |||||||||||||||

| 3(a). | Approval of Amendments to our Certificate of Incorporation – to eliminate supermajority voting requirements for certain business combinations.

| FOR | 68 | |||||||||||||||

| 3(b). | Approval of Amendments to our Certificate of Incorporation and By-Laws -to eliminate supermajority voting requirements to remove a director without cause.

| FOR | 68 | |||||||||||||||

| 3(c). | Approval of Amendment to our Certificate of Incorporation –to eliminate supermajority voting requirement to make certain amendments to our By-Laws.

| FOR | 68 | |||||||||||||||

4. |

Employee Stock Purchase Plan – approve proposed amendment and restatement of the PSEG Employee Stock Purchase Plan. |

FOR |

72 | Ratification of Auditor –ratification of the appointment of Deloitte & Touche LLP as independent auditor for 2014.

| FOR | 70 | ||||||||||||

5. |

Ratification of Auditor – ratification of the appointment of Deloitte & Touche LLP as independent auditor for 2013. |

FOR |

75 | |||||||||||||||

6. |

Stockholder Proposal – stockholder proposal requesting elimination of voting requirements that calls for a greater than simple majority vote. |

AGAINST |

77 | |||||||||||||||

VOTING AND PROCEDURES

Voting is strongly encouraged. We urge you to sign, date and return the accompanying proxy card whether or not you plan to attend the Annual Meeting. For stockholders of record, we have provided several alternative methods for voting, including voting via the Internet or the toll-free telephone number listed below.

Annual Meeting For shares held by a bank or broker, please follow the voting instructions you receive from each of Stockholdersthem. Most banks and brokers are likely to provide you with methods for internet or toll-free telephone voting.

| Annual Meeting of Stockholders | ||||

| Date and Time | April | |||

| Location | The New Jersey Performing Arts Center (NJPAC), One Center Street, Newark, | |||

| Record Date | February Holders of Common Stock outstanding on the record date will have one vote per | |||

PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement 1

| PROXY STATEMENT SUMMARY |

Voting Methods

|

|

|

| |||||||||||||

PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement 1

PROXY STATEMENT SUMMARY

PROXY STATEMENT SUMMARY

To Submit Proposals for 2014 Annual Meeting

| Final Date | November | |||

| Contact | Corporate Secretary, PSEG, 80 Park Plaza, T4B, P.O. Box 1171 Newark, New Jersey 07101-1171 | |||

NOMINEES FOR ELECTION AS DIRECTOR

| Name | Age | Director Since | Primary Occupation | Committee Memberships | Other Public Company Boards | Age

| Director

| Primary Occupation

| Committee

|

Other Public

| ||||||||||||||||

| Albert R. Gamper, Jr. | 71 | 2000 | Retired Chairman of the Board and CEO of CIT Group | Lead Director, A, E, F | 1 | 72 | 2000 | Retired Chairman of the Board and CEO of CIT Group | Lead Director, A, E, F | 1 | ||||||||||||||||

| William V. Hickey | 68 | 2001 | Chairman of the Board and CEO of Sealed Air Corporation | F, FG (Chair), NG (Chair), O | 2 | 69 | 2001 | Retired Chairman of the Board and CEO of Sealed Air Corporation | F(Chair), FG, NG, O | 1 | ||||||||||||||||

| Ralph Izzo | 55 | 2006 | Chairman of the Board, President and CEO of PSEG | E (Chair) | 0 | 56 | 2006 | Chairman of the Board, President and CEO of PSEG | E (Chair) | 1 | ||||||||||||||||

| Shirley Ann Jackson | 66 | 2001 | President of Rensselaer Polytechnic Institute | E, F (Chair), FG, NG, O | 4 | 67 | 2001 | President of Rensselaer Polytechnic Institute | E, F, FG (Chair), NG (Chair), O | 4 | ||||||||||||||||

| David Lilley | 66 | 2009 | Retired Chairman of the Board, President and CEO of Cytec Industries | A (Chair), F, O | 2 | 67 | 2009 | Retired Chairman of the Board, President and CEO of Cytec Industries | A (Chair), F, O | 2 | ||||||||||||||||

| Thomas A. Renyi | 67 | 2003 | Retired Executive Chairman of The Bank of New York Mellon | A, CG (Chair), O | 1 | 68 | 2003 | Retired Executive Chairman of The Bank of New York Mellon | A, CG (Chair), O | 2 | ||||||||||||||||

| Hak Cheol (H.C.) Shin | 55 | 2008 | Executive Vice President – International Operations of 3M Company | A, CG, FG, NG | 0 | 56 | 2008 | Executive Vice President – International Operations of 3M Company | A, CG, FG, NG | 0 | ||||||||||||||||

| Richard J. Swift | 68 | 1994 | Retired Chairman of the Board, President and CEO of Foster Wheeler | CG, E, FG, NG, O (Chair) | 4 | 69 | 1994 | Retired Chairman of the Board, President and CEO of Foster Wheeler | CG, E, FG, NG, O (Chair) | 4 | ||||||||||||||||

| Susan Tomasky | 60 | 2012 | Retired President – AEP Transmission of American Electric Power Corporation | A, CG | 2 | 61 | 2012 | Retired President – AEP Transmission of American Electric Power Corporation | A, CG | 2 | ||||||||||||||||

| Alfred W. Zollar | 58 | 2012 | Retired General Manager – Tivoli Software Division of IBM Corporation | F, FG, NG | 1 | 59 | 2012 | Retired General Manager – Tivoli Software Division of IBM Corporation | F, FG, NG | 1 |

A=Audit CG=Corporate Governance E=Executive F=Finance FG=Fossil Generation NG=Nuclear Generation O=Organization and Compensation

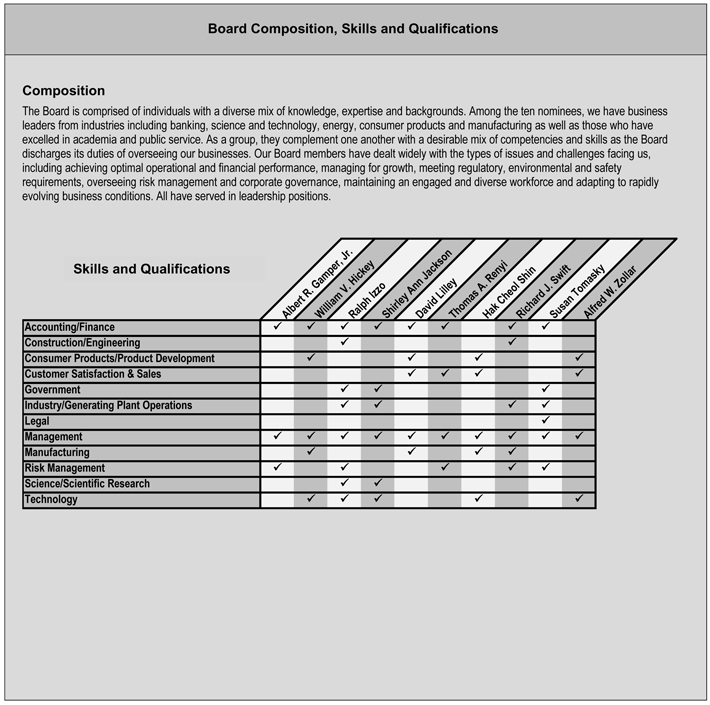

We believe that our directors are a diverse group of highly qualified leaders with a broad range of business, industry, academic and public service experience. Their skills in the areas of accounting, finance, construction, consumer products, sales, government, law, operations, management, science, technology and risk management serve us well.

2 PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement

| PROXY STATEMENT SUMMARY |

CORPORATE GOVERNANCE

We have adopted what we believe are strong corporate governance standards and practices to assure effective management by our executives and oversight by our Board of Directors (Board). These measures include the following:

Independent Directors |

| Risk Management | Code of Ethics | |||

| The Board has established standards for director independence, which are set forth in our Corporate Governance Principles (Principles). All of our current directors and nominees are independent under our Principles and the requirements of the New York Stock Exchange (NYSE), except Ralph Izzo, our Chairman of the Board, President and Chief Executive Officer (CEO), who is an employee of the Company. |

|

|

|

2 PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement

PROXY STATEMENT SUMMARY

PROXY STATEMENT SUMMARY

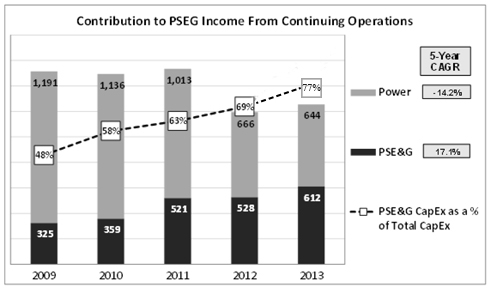

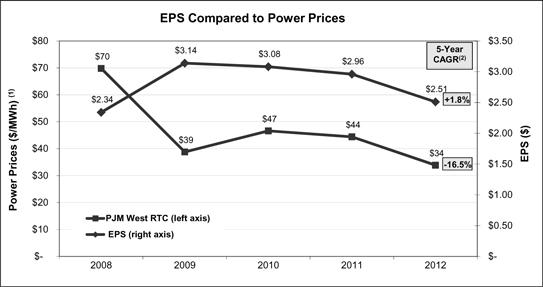

BUSINESS PERFORMANCE

In 2012, our financial results continuedOur business plan is designed to be adversely impacted by lowermanage the risks associated with fluctuations in commodity prices for electricity and natural gaschanges in the marketsconsumer demand as we serve, while uncertainty concerninginvest to achieve growth in light of market, regulatory and environmental policies dampened investor returns. Electricity prices remained low due to a combination of a decline in demand growth and sustained low natural gas prices. The slow economic recovery has negatively impacted utility sales, as well as prices in the wholesale energy and capacity markets in whichtrends. In 2013, we operate. The continued decline in wholesale natural gas prices, resulting from greater supply from shale production, further contributed to the continuing decline in the wholesale price of electricity.

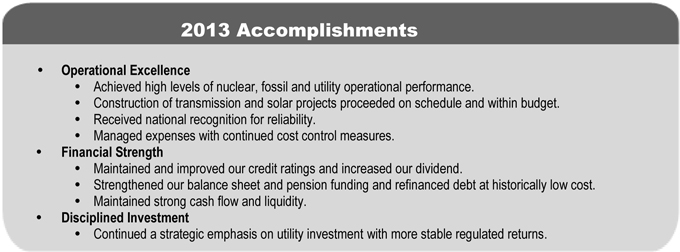

In response to the challenging conditions facing our industry, we remained committed to our strategy of pursingfocus on operational excellence, financial strength and disciplined investment. We endedThese guiding principles have provided the yearbase from which we have been able to execute our strategic initiatives, including:

Compared to the prior year, year over year earnings were lower, but within our targeted range and the price of our Common Stock was lower at year end. While power prices declined approximately 24% from 2011 to 2012, through executing our strategy the decline in our earnings was, in comparison, approximately 15% during the same period.

Financial Highlights

| YE 2012 ($ 000’s) | YE 2011 ($ 000’s) | |||||||||||||||||||

| Dollars in Millions, except per share amounts |

2013 ($) |

2012 ($) | ||||||||||||||||||

| Total Revenues | 9,781 | 11,079 | 9,968 | 9,781 | ||||||||||||||||

| Income from Continuing Operations | 1,275 | 1,407 | 1,243 | 1,275 | ||||||||||||||||

| Net Income | 1,275 | 1,503 | 1,243 | 1,275 | ||||||||||||||||

| Total Assets | 31,725 | 29,821 | 32,522 | 31,725 | ||||||||||||||||

Earnings Per Share - Diluted | ($) | ($) | ||||||||||||||||||

Income from Continuing Operations | 2.51 | 2.77 | 2.45 | 2.51 | ||||||||||||||||

Net Income | 2.51 | 2.96 | 2.45 | 2.51 | ||||||||||||||||

| Dividends Paid per Share | 1.42 | 1.37 | 1.44 | 1.42 | ||||||||||||||||

| Market Price per Share | 30.60 | 33.01 | ||||||||||||||||||

Market Price per Share - Year-end | 32.04 | 30.60 | ||||||||||||||||||

For a more comprehensive assessment of the Company’s performance, please review the entire Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 20122013 (Form 10-K).

PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement 3

| PROXY STATEMENT SUMMARY |

EXECUTIVE COMPENSATION

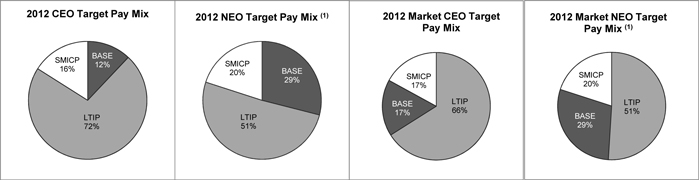

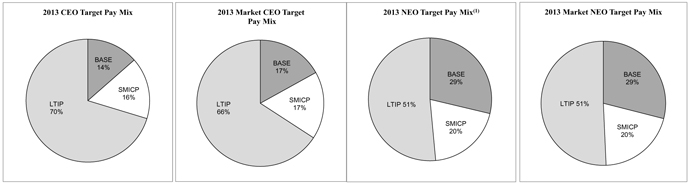

Compensation Philosophy

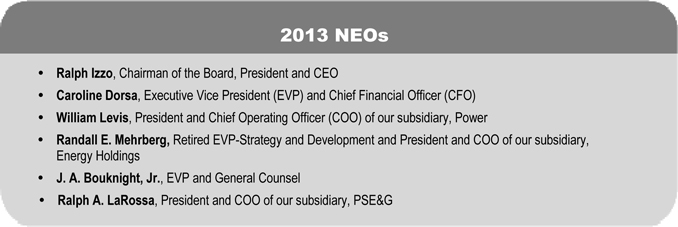

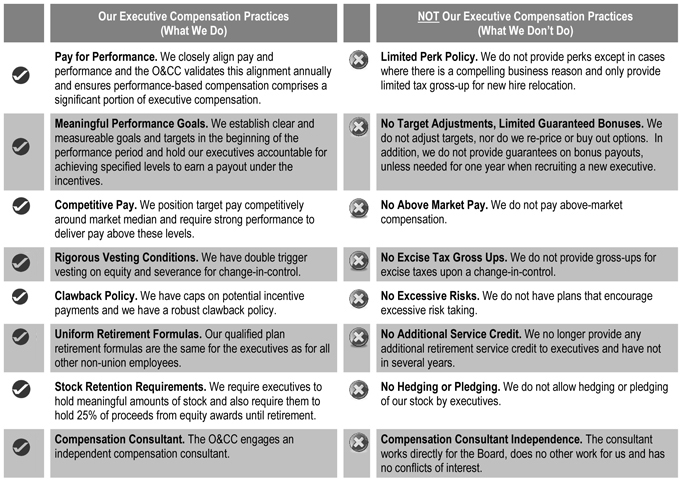

We have designed a competitive performance-oriented executive compensation program that we believe helps us recruit and retain top talent while closely linking pay to performance, which we benchmark to industry peers.performance. We seek to align the interests of our executive officers, including our CEO and the Named Executive Officers (NEOs) reported in this Proxy Statement, with those of our stockholders through performance-oriented short-term and long-term incentive opportunities. Ultimate payment dependsThese pay-at-risk incentives are targeted to pay out at approximately the benchmarked industry peer median when we deliver on our goals. Amounts earned under our Senior Management Incentive Compensation Plan (SMICP) and Amended and Restated 2004 Long-Term Incentive Plan (LTIP) depend upon performance, measured against financial and other business results, utilizing internal targets and relevant peer group comparisons.

In setting and overseeing executive compensation, our Board utilizes an independent compensation consultant which provides no otheronly compensation services to us.the Board. A detailed discussion of our executive compensation program, including its elements, the factors we use in determining compensation and our governance features, appears below in the Compensation Discussion and Analysis (CD&A).

We have adopted executive compensation governance measures that we believe support good governance practices and further align our executive’s interests with those of stockholders, including:

Our program provides the following compensation:

Base | ||||||

| • | Experience, performance and competitive market. | |||||

| Annual cash incentive | ||||||

PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement 3

PROXY STATEMENT SUMMARY

PROXY STATEMENT SUMMARY

• • | Multiple performance measures with emphasis on EPS as the corporate objective; and Payment from zero to 150% of target percentage of salary, and up to 200% for exceptional performance. | |||||

| Equity-based incentive awards under our | ||||||

• | 60% performance share units (PSUs), with payment, if any, measured over a three-year period against Return on Invested Capital (ROIC) and relative Total Shareholder Return (TSR), with the opportunity to earn between zero and 200% of target based on performance; and | |||||

| • | 40% restricted stock units (RSUs), which cliff vest at the end of three years. | |||||

Market-based retirement and post-employment benefits | ||||||

We have adopted executive compensation governance measures, including:

• | Double trigger change-in-control provisions; and No excise-tax gross-ups. | |||||

4 PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement

| PROXY STATEMENT SUMMARY |

|

|

|

|

Pay for Performance

We believe that our pay for performance philosophy is critical to our continued success and that our program effectively focuses our executives on creating sustained stockholder value without encouraging excessive risk. By emphasizing incentive-based compensation, our CEO and NEOs will be rewarded based upon our achieving financial and operating results, with the ultimate payout of a significant portion of their total compensation determined relative to the achievement of our goals. For 2013, the target annual and long-term incentive pay for our CEO was 88%86% and the average target annual and long-term incentive pay for our NEOs was 71% of targeted total direct compensation, respectively.

When we compared our recent financial performance with the compensation of our CEO and NEOs, we found that the financial measures we examined were at approximately the median of our peer group of companies and our executive compensation was at or below the peer median. Thus, we concluded that our performance and executive compensation are appropriately aligned. Further, performance is reflected in the actual value of the one-year annual cash incentive payments and the three-year equity incentive compensation paid upon vesting of awards. awards:

These realized compensation amounts reflect the Option Exerciseseffect on earnings of our strategic initiatives and Stock Vested During 2012 Table.the rebalancing of our business mix.

The following table provides highlights of the compensation for our CEO and other NEOs in 20122013 as reported in the 20122013 Summary Compensation Table in this Proxy Statement. For the complete details of compensation, please review the entire Proxy Statement.

| Base Salary | Equity Incentive Plan Compensation | Non-Equity Incentive Plan Compensation | Total Compensation | |||||||||||||||||||||||||||||

| 2012 | 2012 | 2012 | 2012 | ||||||||||||||||||||||||||||

| NEO | ($) | ($) | ($) | ($)(1) | Base Salary

($) |

Equity Incentive Plan 2013

($) | Non-Equity Incentive

($) | Total

($)(1) | ||||||||||||||||||||||||

| Ralph Izzo | 1,004,715 | 5,724,001 | 1,653,800 | 10,513,543 | 1,092,615 | 6,367,186 | 1,874,400 | 9,400,649 | ||||||||||||||||||||||||

| Caroline Dorsa | 595,691 | 1,099,985 | 567,900 | 3,678,237 | 617,686 | 1,199,928 | 589,800 | 2,971,021 | ||||||||||||||||||||||||

| William Levis | 560,377 | 1,099,985 | 546,200 | 2,989,703 | 565,485 | 2,223,214 | 607,600 | 3,582,160 | ||||||||||||||||||||||||

Randall E. Mehrberg | 553,414 | 924,182 | 499,400 | 2,716,866 | ||||||||||||||||||||||||||||

| Randall E. Mehrberg(2) | 549,595 | 1,029,280 | 495,400 | 2,143,929 | ||||||||||||||||||||||||||||

| J. A. Bouknight, Jr. | 535,570 | 849,495 | 461,300 | 1,926,914 | 544,922 | 943,788 | 496,700 | 2,070,969 | ||||||||||||||||||||||||

| Ralph A. LaRossa | 497,142 | 824,611 | 400,700 | 2,332,861 | 499,078 | 943,788 | 438,800 | 1,946,149 | ||||||||||||||||||||||||

(1) Reflects all compensation, including change in pension value and all other, as reported in the 2013 Summary Compensation Table.

(2) Retired on December 2, 2013.

|

Key Recent Executive Compensation Actions

In overseeing our executive compensation program, our Organization and Compensation Committee (O&CC), working with its consultant, continued to emphasize our results oriented philosophy. During 2012,2013, we:

|

Confirmed the pay for performance alignment of executive compensation with financial results and approved benchmarked salaries, incentive awards and payouts in accordance with established criteria; and Increased the stock ownership guideline for the CEO from 5x to 6x base salary to better align with market. For a more comprehensive discussion, see our CD&A. |

4 PUBLIC SERVICE ENTERPRISE GROUP |l20132014 Proxy Statement 5

| ANNUAL MEETING, VOTING AND PROCEDURES |

ANNUAL MEETING, VOTING AND PROCEDURES

ANNUAL MEETING, VOTING AND PROCEDURES

| ||

This Proxy Statement is furnished by PSEGus on behalf of the Board. We are soliciting proxies to be voted at the 20132014 Annual Meeting of Stockholders scheduled to be held on April 16, 201315, 2014 and at all adjournments or postponements of that meeting.

The mailing address of our principal executive offices is 80 Park Plaza, P.O. Box 1171, Newark, New Jersey 07101-1171, telephone (973) 430-7000. Our Internet website iswww.pseg.com.

In an effort to encourage stockholder voting, we have structured our Proxy Statement in an easy-to-read format. After describing each proposal, we provide the related information for you to consider in voting. Accordingly:

|

|

|

Proposal 4.Ratification of the Appointment of Independent Auditor(page 70) is followed by our Audit Committee Report and disclosure of our Independent Auditor’s fees.

|

|

|

We have provided without charge to each person solicited by means of this Proxy Statement a copy of our Form 10-K, which has been filed with the Securities and Exchange Commission (SEC). Each such copy of the Form 10-K does not include any exhibits thereto, but is accompanied by, including a list briefly describing all suchthe related exhibits. We will furnish any such exhibit upon request. Any such You may request should be made incopies of the exhibits by writing to: Vice President-Investor Relations, Public Service Enterprise Group Incorporated, 80 Park Plaza, T6B, P.O. Box 1171, Newark, New Jersey 07101-1171. The Form 10-K is also available on our websitewww.pseg.com/info/investors/financial_info/index.jsp.

Delivery of Documents and Internet Availability

Each stockholder receives his or her own proxy card by which to vote. In future years, we intend to sendWe have sent only a single copy of each of our Annual Report to Stockholders, in which we will includeincluding our Form 10-K, and Proxy Statement, to any household at whichwith two or more stockholders reside if they appear to be members ofhaving the same family,last name and address unless one of the stockholders at that address notifies us to requesthas requested individual copies. This “householding” saves our company printing and delivery costs. If you share an address with another stockholder and receive only a single copy of one of those documents, we will send you may request an additional copy if you send a written requestby writing to the above address noted above or phonecontacting us at (973) 430-6566.

OurStockholders may choose to no longer receive printed copies of our Annual Report, to Stockholders, Form 10-K and Proxy Statement are availableand instead receive and view them electronically over the Internet.internet. If you are a stockholder of record and would like to receive these documents, as well as other stockholder communications and materials, electronically in the future and save our companyus the cost of producing and mailing them to you, you may do so by following the instructions atwww.ematerials.com/www.proxypush.com/peg. If your shares are held in the name of a bank or broker, please follow that organization’s instructions for electronic delivery. You may also follow the instructions provided for future electronic delivery if you vote via the Internet.

If you receive our future Proxy Statements, Annual Reports and Forms 10-K electronically over the Internet, you will receive each year an e-mail message containing the Internet address to access these documents. The e-mail will also include instructions for voting via the Internet as you will not receive a separate proxy card.

This year, due to a change of our registrar and transfer agent, we are not able to provide “householding” or electronic delivery.

6 PUBLIC SERVICE ENTERPRISE GROUP |l20132014 Proxy Statement 5

ANNUAL MEETING, VOTING AND PROCEDURES

ANNUAL MEETING, VOTING AND PROCEDURES

| ANNUAL MEETING, VOTING AND PROCEDURES |

Attendance

Our Annual Meeting will be held on Tuesday, April 16, 2013 at 1:00 P.M., at the NJPAC in Newark, New Jersey. We request that if you plan to attend the Annual Meeting, you should so indicate on the proxy card or when voting your shares telephonically or electronically. We have included transportation information and a map on the back cover of this Proxy Statement.Please bring with you evidence that you are a stockholder.

Holders of record of the 505,961,739506,164,959 shares of Common Stock outstanding on February 15, 201314, 2014 will have one vote per share. A quorum will consist of the holders of Common Stock entitled to cast a majority of the votes at the Annual Meeting, present in person or represented by proxy. All votes cast by proxy or in person will be counted. Abstentions and broker non-votes will not be counted, except for the purpose of establishing a quorum. All votes will be tabulated by an independent inspector of elections.

Election of directors under Proposal 1 is subject to our majority vote requirement described below. The say-on-pay vote presented in Proposal 2 is advisory and non-binding, whether or not approved by a majority of the votes cast. The approval of the respective amendment and restatement of each of the LTIPamendments to our Certificate of Incorporation and ESPP under Proposal 3By-Laws set forth in Proposals 3(a), 3(b) and Proposal 4, respectively, requires receipt3(c) must receive a favorable vote of a majorityat least 80% of the votes cast with respectoutstanding shares eligible to each.vote to be approved. A majority of the votes cast is needed for the Proposal 5 ratification of the auditor. The stockholder proposal contained inauditor under Proposal 6 must receive a majority of the votes cast to be approved, but is non-binding on us. Any change to our governing documents as set forth in Proposal 6 would require additional action by our Board and our stockholders, as described further below.4.

Proxy Card and Voting of Shares

Every vote is important. We urge you to vote whether or not you plan to attend the Annual Meeting. Kindly sign, date and return the accompanying proxy card or, if you are a stockholder of record, you may vote your proxy using the toll-free telephone number listed on the proxy card or via the Internet at the electronic address provided above and also listed on the proxy card. When a proxy card is returned properly dated and signed, or properly voted telephonically or electronically, the shares represented by the proxy will be voted by the persons named as proxies in accordance with the voting stockholder’s directions.

You may specify your choices by marking the appropriate boxes on the enclosed proxy card. The proxy card also includes any shares registered in the names shown on the proxy in Enterprise Direct (our dividend reinvestment and stock purchase plan) and the PSEG ESPP.. If a proxy card is dated, signed and returned without specifying choices, the shares will be voted as recommended by the Board. If you vote telephonically or electronically, you should follow the directions given during the call or on the computer screen. If you are a stockholder of record, your shares will not be voted unless you provide a proxy by return mail, telephonically or electronically or vote in person at the Annual Meeting. However, ifIf you are participant in the PSEG Employee Stock Purchase Plan (ESPP), you will receive a separate direction card from the administrator of the plan. If no instructions are received from you with respect to any shares held in Enterprise Direct or the ESPP, the respective administrator of that plan will vote those shares in accordance with the recommendations of the Board.

If you are a participant in the PSEG Thrift and Tax-Deferred Savings Plan or the PSEG Employee Savings Plan of PSEG (PSEG Savings Plans) or either of the two Incentive Thrift Plans (Incentive Thrift Plans) of Long Island Electric Utility Servco LLC, a subsidiary of PSEG LI, you will receive a separate direction card from the respective plan’s trustee for shares that have been allocated to your accounts. The trustee will vote the shares of Common Stock beneficially owned by you under the respective plan in accordance with your instructions. If no instructions are received with respect to the PSEG Savings Plans, the shares will not be voted. If no instructions are received with respect to the Incentive Thrift Plans, the respective trustee will vote your shares in the same proportion as those shares as to which it receives instructions from other participants in the plan in which you participate.

If your shares are held in the name of a bank or broker, you should follow the voting instructions on the form received from your bank or broker. For such shares, while the availability of telephone or Internet voting will depend on the voting processes of your bank or broker. Ifbroker, we believe that most will make such voting methods available. In accordance with the rules of the NYSE, if no instructions are received from you by a bank or broker with respect to such shares, the shares may be voted by the bank or broker on certain of the proposals in this Proxy Statement at the discretion of the bank or broker in accordance with the rules of the NYSE. The NYSE rules provide that if no instructions are received from you, a bank or broker may use its discretion to vote your shares that are held by it only in regard to Proposal 5,4, Ratification of the Appointment of Independent Auditor.

A bank or broker may not vote your shares held by it in regard to Proposal 1. Election of Directors, Proposal 2. Advisory Vote on the Approval of Executive Compensation, Proposal 3. Approval of LTIP, Proposal 4. Approval of ESPP and Proposal 6. Shareholder Proposal on Simple Majority Voting, unless it receives instructions from you. If you do not provide instructions to your bank or broker as to how you wish to vote in respect of each of these matters, your shares will not be voted on these matters.

A bank or broker may not vote your shares held by it in regard to Proposal 1 - Election of Directors, Proposal 2 - Advisory Vote on the Approval of Executive Compensation, and Proposals 3(a), 3(b) and 3(c) – Amendments to Certificate of Incorporation and By-Laws, unless it receives instructions from you. If you do not provide instructions to your bank or broker as to how you wish to vote in respect of each of these matters, your shares will not be voted on these matters. |

6 PUBLIC SERVICE ENTERPRISE GROUP |l20132014 Proxy Statement 7

ANNUAL MEETING, VOTING AND PROCEDURES

ANNUAL MEETING, VOTING AND PROCEDURES

| ANNUAL MEETING, VOTING AND PROCEDURES |

If any matters not described in this Proxy Statement should properly come before the Annual Meeting, the persons named in the enclosed proxy card or their substitutes will vote proxies given in said form of proxy in respect of any such matters in accordance with their best judgment. As of the date of this Proxy Statement, the Board and management did not know of any other matters which might be presented for stockholder action at the Annual Meeting.

You may revoke a proxy given in the form of the card which accompanies this Proxy Statement or a vote made telephonically or electronically. However, by law, your presence at the Annual Meeting will not revoke a proxy you have given unless you file a written notice of such revocation with the Secretary of PSEG prior to the voting of the proxies at the Annual Meeting or you vote the shares subject to the proxy by written ballot.

The cost of soliciting proxies in the form accompanying this Proxy Statement will be borne by us. In addition to solicitation by mail, proxies may be solicited by our directors, officers and employees, none of whom will be directly compensated for such services, in person or by telephone, electronically or by facsimile. We have also retained Morrow & Co. to assist in the distribution and solicitation of proxies from brokers, bank nominees, other institutional holders and certain large individual holders. The anticipated cost of such services is approximately $13,500,$14,500, plus reimbursement of expenses.

Date for Submission of Stockholder Proposals

AnyIn accordance with SEC rules, stockholders may submit proposals intended for inclusion in the Proxy Statement in connection with our 20142015 Annual Meeting of StockholdersStockholders. Such proposals should be sent to: Corporate Secretary, Public Service Enterprise Group Incorporated, 80 Park Plaza, T4B, P.O. Box 1171, Newark, New Jersey 07101-1171, and must be received by November 8, 2013.7, 2014.

Discretionary Proxy Voting Authority

If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the persons named in the enclosed proxy card or their substitutes will vote proxies so given in respect of any such matters in accordance with their best judgment. As of the date of this Proxy Statement, the Board and management did not know of any other matters which might be presented for stockholder action at the Annual Meeting.

If we are not notified by January 22, 20142015 of any proposal intended to be presented for consideration at the 20142015 Annual Meeting of Stockholders, then the proxiespersons named by us with respect to that meeting shall have discretionary voting authority with respect to such proposal if presented at that meeting.Annual Meeting.

8 PUBLIC SERVICE ENTERPRISE GROUP |l 20132014 Proxy Statement 7

ELECTION OF DIRECTORS

ELECTION OF DIRECTORS

| ELECTION OF DIRECTORS |

|

You are being asked to vote on the election of ten individuals nominated by your Board to serve as the Directors of our Company. In this Proxy Statement,Below, we are providing you withhave provided information about the Board, director independence, our leadership structure, risk management oversight, Board committees, code of ethics and related matters of corporate governance. We also describe our provisions for majority voting, our director qualifications, diversity and retirement criteria and theeach nominee’s specific experience, skills and qualifications of each nominee.qualifications. We also report to you information about security ownership and director compensation.As recommended by the Board, we ask you to vote forFOR all nominees.

Our business and affairs are managed by or under the direction of the Board, which delegates certain responsibilities to its committees and to management consistent with our By-Laws. The Board has adopted and operates under the Principles which reflect our current governance practices in accordance with applicable statutory and regulatory requirements, including those of the SEC and the NYSE. OurYou can request copies of our By-Laws and Principles are posted on our website,or view them atwww.pseg.com/info/investors/governance/index.jsp. We will send you a copy of either or both upon request.

The Board provides direction and oversight of the conduct of our business by management. In fulfilling these responsibilities, the Board performs the following principal functions:

|

|

|

|

|

The Board has full and free access to all members of management and may hire its own consultants and advisors as it deems necessary.

Under our Principles and the requirements of the NYSE, the Board must consist of a majority of independent directors. The Board has established standards for director independence, which are set forth in the Principles.

8 PUBLIC SERVICE ENTERPRISE GROUP |20132014 Proxy StatementStatement 9

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Independence Standards

In order to be independent:

|

|

|

|

|

|

|

|

These limitations apply for three years after the endThe Board annually reviews other commercial relationships of the applicable affiliation or arrangement.directors and determines whether any of those relationships are material relationships that impair a director’s independence.

The Board has determined that all of the current directors, and all of thewhom are nominees for election, as directors are independent under our Principles and the requirements of the NYSE, except Ralph Izzo, our Chairman of the Board, President and CEO. These determinations were based upon a review of the responses submitted by each director and nominee to questionnaires we provided to them, relevant business records, publicly available information and applicable SEC and NYSE requirements.

Under our By-Laws, our senior leadership may include a Chairman of the Board, a President and a CEO, which positions may be held by one person or may be divided between two different people. As provided in its charter, the Corporate Governance Committee has the responsibility to assess the structure of the Board and periodically evaluate the Board’s governance practices as well as the Principles. Building on the advice of the Corporate Governance Committee, the Board applies its experience and knowledge of our business to establish what it believes to be the most effective form of organization. In doing so, it utilizes its understanding of the challenges and opportunities we face and its evaluation of the individuals who are involved.

Based on that analysis and evaluation, the Board has determined that, at the present time and given our present officers and personnel, it is in the best interests of the Company and stockholders for a single individual to hold all three positions of Chairman of the Board, President and CEO. The Board believes that this strikes a desirable balance allowing us to benefit from the advantages of efficiency, coordination and accountability. Ralph Izzo currently holds these positions. As such, he has plenary powers of supervision and direction of our business and affairs and he also presides at all meetings of the Board and of stockholders. The Board believes that Mr. Izzo possesses the attributes of experience, judgment, vision, managerial skill and overall leadership ability essential for our continued success. Mr. Izzo’s in-depth knowledge and understanding of our strategy, operations, risk profile, regulatory and environmental circumstances and financial condition best position him to head our Board and provide leadership to management, employees, investors, customers, officials and the public. The diverse experience and independence of the other directors allows the Board to maintain effective oversight of operations, long-range planning, finances and risk management.

In addition to the Chairman, President and CEO, our leadership structure is designed to rely on the contributions of our Lead Director. The Lead Director provides the independent directors with a key means for collaboration and communication regarding Board agendas and the information directors receive from management. Importantly, all directors play an active role in overseeing the company’s business both at the Board and Committee level,committee levels, bringing fresh and differing viewpoints. The Lead Director coordinates with the Chairs of our various Board committees in setting agendas for committee meetings. Albert R. Gamper, Jr. currently serves as Lead Director. In that capacity, he complements the talents and contributions of Mr. Izzo and promotes confidence in our governance structure by providing an additional perspective to that of management. Our Principles provide for the following:

PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement 9

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Lead Director Duties and Responsibilities

|

|

|

|

|

|

|

The Lead Director is an independent director designated annually by the non-managementindependent directors with the expectation that he or she will typically serve in that capacity for four years. The Lead Director may be appointed to serve up to twelve additional months beyond the four years if approved by a majority of the non-management independent directors. Mr. Gamper was designated as our Lead Director by the Board in April 20122013 for a term expiring at the first meeting of directors after the 20132014 Annual Meeting of Stockholders. Mr. Gamper has served as Lead Director since April 2011. The Corporate Governance Committee expects to make a recommendation regarding the individual to serve as Lead Director at its first meeting following the 20132014 Annual Meeting, in accordance with our policy.

10 PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement

| CORPORATE GOVERNANCE |

The Board believes that our leadership structure has been designed with the appropriate controls to support the efficacy of this arrangement without jeopardizing the integrity of the governance process. A majority of the Board must consist of independent directors in accordance with our Principles and, currently, Mr. Izzo is our only director who is not independent. As discussed below, our Principles also set forth various expectations and criteria for Board membership. All directors must adhere to our Standards and exercise their responsibilities in a manner consistent with our best interests and those of our stockholders and their fiduciary duties established by applicable law.

The Board is responsible for the oversight of risk at PSEG, both as a whole and through delegation to Board committees, which meet regularly and report back to the full Board. All committees play significant roles in carrying out the risk oversight function. In particular:

|

|

|

|

|

Risk management is also a key part of our strategic planning and business operations. The Board has approved a Risk Management Policy and it reviews and adopts the Company’s Financial Risk Management Practice. The Financial Risk Management Practice serves to define the major roles, responsibilities and procedures, including controls and reporting, necessary to actively manage our financial risk exposure

10 PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

consistent with our business plans. It is reviewed annually and approved by the Audit Committee and the Finance Committee and recommended to the Board for its approval.

Risk Management Program

The Board also has oversight of the Risk Management Program which consists of policies, processes and controls, including the Risk Management Policy and Financial Risk Management Practice, as well as other policies and practices developed by management relating to:

|

|

|

|

|

|

Our Risk Management Program forms an integral part of our corporate culture and values.

We have established a management-level Risk Management Committee (RMC) consisting of senior executives, that is responsible for assessing exposure and determining our overall financial risk management strategy, taking into consideration, when appropriate, operational, regulatory and legal risks. The RMC consisting of senior executives, is charged with, among other things:

PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement 11

|

|

|

|

In addition, our Capital Review Committee, which also consists of senior management employees, provides oversight and reviews proposed capital projects. Investments above a stated amount require approval of our Board or theour respective subsidiary’s board, of Power, PSE&G or Energy Holdings, as applicable. Our Compliance Committee of senior management personnel reviews various compliance issues, including the approval of our Standards, and regularly reports to the Audit Committee.

Our Delegation of Authority setsprovisions set forth the respective authority levels at which management and employees are authorized to conduct business.

The Board believes that we have an effective system of risk management practices with appropriate controls and Board oversight.

The Board takes very seriously its responsibility to provide for an orderly process of succession within the ranks of our senior management. The O&CC periodically reviews with the CEO succession plans for key leadership positions to assure that highly qualified candidates are available should the need arise to fill vacancies. We seek to maintain a continuity of management through appropriate recruitment and retention methods, including market-based and performance-measured compensation and career advancement and training opportunities.

The Board holds regularly scheduled meetings and meets on other occasions when circumstances require. Board and Committeecommittee meetings are scheduled over most of an entire work day and oftenusually begin on the prior afternoon or evening. Each particular meeting typically takes approximately two to three hours or longer. Each Committeecommittee executes its responsibilities, as described below, and the Board receives reports from the Committeecommittee Chairs on the significant matters considered and actions taken. A Board meeting typically focuses on the strategic and more important issues facing us. Directors spend additional time preparing for Board and Committeecommittee meetings they attend and they are called upon for counsel between meetings.

Our Principles provide that the Board will meet at least six times each year and in executive session without management in attendance at every meeting, unless waived by the Board. When the Board meets in executive sessions, the Lead Director presides. In addition, each Board committee, except the Executive Committee, meets in executive session at each of its meetings, unless waived by the respective Committee.

committee.

Under our Principles, each director is expected to attend all Board meetings and all meetings of committees of which such director is a member, as well as the Annual Meeting of Stockholders. Meeting materials are provided to Board and Committee members in advance of each meeting, and members are expected to review such materials prior to each meeting. During 2012,2013, each incumbent director attended at least 75% of the aggregate number of meetings of the Board meetings and each committee meetings on which he or she served. EachWith the exception of Mr. Gamper, each director attended the 20122013 Annual Meeting of Stockholders.

| 2013 Meetings and Executive Sessions | ||||

Board/Committee

| Meetings | Executive Sessions | ||

PSEG Board | 7* | 7 | ||

PSE&G Board | 6 | 6 | ||

Audit | 8 | 5 | ||

Corporate Governance | 4 | 4 | ||

Executive | 0 | 0 | ||

Finance | 4 | 0 | ||

Fossil Generation Operations Oversight | 3** | 2 | ||

Nuclear Generation Operations Oversight | 3*** | 2 | ||

Organization and Compensation | 5 | 5 | ||

*Includes an all-day business strategy session

**One meeting held at a generating station

***One meeting held at the site of nuclear generating stations we operate

12 PUBLIC SERVICE ENTERPRISE GROUP |l 20132014 Proxy Statement 11

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

| CORPORATE GOVERNANCE |

2012 Meetings and Executive Sessions

Board/Committee

|

Meetings

|

Executive Sessions

| ||

PSEG Board | 7* | 7 | ||

PSE&G Board | 6 | 6 | ||

Audit | 8 | 5 | ||

Corporate Governance | 4 | 4 | ||

Executive | 0 | 0 | ||

Finance | 4 | 0 | ||

Fossil Generation Operations Oversight | 3** | 2 | ||

Nuclear Generation Operations Oversight | 3*** | 2 | ||

Organization and Compensation | 5 | 5 |

Director Orientation and Continuing Education

New directors receive an orientation program and materials, which includes visits to our facilities and presentations by senior management to familiarize new directorsthem with our strategic plans, operations, significant financial, accounting and risk management issues, compliance programs, the Standards, principal officers and internal and independent auditors. During each year, continuing education is provided to all directors on topics of importance to our business.

Our Principles require that directors own shares of our Common Stock (including any restricted stock, whether or not vested, any stock units under the Directors’ Equity Plan and any phantom stock under the Directors’ Deferred Compensation Plan) equal to four times the annual cash retainer (currently $70,000) within five years after election to the Board. All incumbent directors currently meet this requirement, except Ms. Tomasky and Mr. Zollar, each of whom was first elected to the Board in 2012.

You, as a stockholder, and other interested parties may communicate directly with the Board, including the independent directors, by writing to:

M. Courtney McCormick, Secretary

Public Service Enterprise Group Incorporated

80 Park Plaza, T4B, P.O. Box 1171, Newark, New Jersey 07101-1171,

and indicating who should receive the communication. Unless the context otherwise requires, the Secretary will provide the communication to the Lead Director and to the Chair of the Board Committeecommittee most closely associated with the nature of the request. The Secretary has the discretion not to forward communications that are commercial advertisements, other forms of soliciting material or billing complaints. All communications are available to any member of the Board upon his or her request.

The Board committees, of the Board, their principal functions, and membership requirements and minimum number of meetings held are described below. Each committee has open and free access to all Company information, may require any of our officers or employees to furnish it with information, documents or reports that it deems necessary or desirable in carrying out its duties, is empowered to investigate any matter involving us and may retain appropriate resources to assist it in discharging its responsibilities.

Each committee, other than the Executive Committee, operates pursuant to a charter that defines its roles and responsibilities and annually conducts a performance evaluation of its activities and a review of its charter. The authority of the Executive Committee is set forth in our By-Laws. The committee charters and our By-Laws are posted on our website,www.pseg.com/info/investors/governance/committees.jsp. We will send you a copy of any or all of them upon request.

Each committee reports its activities to the Board. Each committee Chair is appointed annually with the expectation that he or she will typically serve in that capacity for four years. A Chair may be appointed to serve up to twelve additional months beyond the four years if approved by a majority of the independent directors.

12 PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Committee |

Membership Requirements | |

Audit |

Members may receive no direct or indirect compensation from us or our subsidiaries, other than as a director or committee member, and may not be affiliated with us or our | |

Corporate Governance | ||

Consists of three or more independent directors who meet at least two times per

| ||

Executive | Consists of the Chairman of the Board, the Lead Director and at least one additional independent director. | |

Finance | Consists of three or more independent directors who meet at least three times per year. | |

Fossil Generation Operations Oversight | Consists of three or more independent directors who meet at least three times per year. | |

Nuclear Generation Operations Oversight | Consists of three or more independent directors who meet at least three times per year. | |

Organization & Compensation | Consists of three or more independent directors in accordance with SEC and NYSE rules, who meet at least two times per year. | |

PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement 13

| CORPORATE GOVERNANCE |

Audit Committee

The Audit Committee’s responsibilities include:

|

|

Reviewing |

|

|

|

|

|

|

|

The Board determines annually, and upon any change in Audit Committee composition, the independence financial literacy and financial expertise of the Audit Committee membersindependent auditor, as well as Public Company Accounting Oversight Board (PCAOB) and makes written affirmation to the NYSE in accordance with its rules. The Board has determined that all memberspeer review reports of the Audit Committee are financially literateindependent auditor’s performance;

PUBLIC SERVICE ENTERPRISE GROUP | 2013 Proxy Statement 13

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Thomas A. Renyi, and Susan Tomasky, each a member of the Audit Committee, is an audit committee financial expert under the Sarbanes-Oxley Act of 2002statements and the rulesacceptability and quality of our financial statements and our accounting, reporting and auditing practices;

Managementindependent auditor any audit issues or difficulties and management’s response, and resolving disagreements which may arise between management and the Board believe thatindependent auditor regarding financial reporting;

The Audit Committee Report appears below under Proposal 5.4. Ratification of the Appointment of Independent Auditor in this Proxy Statement.

Corporate Governance Committee

The Corporate Governance Committee’s responsibilities include:

14 PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement

|

|

|

|

|

|

|

|

|

|

|

|

|

The nomination process and criteria utilized are described below under Nominees and Election.

Executive Committee

Except as otherwise provided by law, the Executive Committee may exercise all the authority of the Board when the Board is not in session.

Finance Committee

The Finance Committee’s responsibilities include:

|

|

|

|

|

|

|

Reviewing with management credit agency ratings and analyses.

|

14 PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Fossil Generation Operations Oversight Committee

The Fossil Generation Operations Oversight Committee’s responsibilities include:

|

|

Reviewing the results of major inspections, evaluations and audit findings by external oversight groups and management’s response.

|

Nuclear Generation Operations Oversight Committee

The Nuclear Generation Operations Oversight Committee’s responsibilities include:

PUBLIC SERVICE ENTERPRISE GROUP |2014 Proxy Statement 15

|

|

|

|

Organization and Compensation Committee (O&CC)

The O&CC’s responsibilities include:

|

|

|

|

|

|

|

|

|

|

|

|

|

The O&CC Report on Executive Compensation appears below under Proposal 2. Advisory Vote on the Approval of Executive Compensation.

The O&CC has the authority to retain advisors and compensation consultants, with sole authority for their hiring and firing. The O&CC is directly responsible for such appointment, compensation and oversight in accordance with the applicable SEC requirements and NYSE standards. Since September 2009, the O&CC has retained Compensation Advisory Partners LLC (CAP) as its independent compensation consultant to provide it with information and advice that is not influenced by management. CAP is an executive compensation consulting firm that does not perform any other services for us or our subsidiaries. CAP provides advice to the O&CC on executive compensation and may also provide advice to the Corporate Governance Committee on matters pertaining to compensation of directors who are not executive officers. CAP may not perform any other services for us without obtaining the prior approval of the Chair of the O&CC.

Responsibility for assignment to and evaluation of work by CAP is solely that of the O&CC and, with respect to the compensation of non-employee directors, the Corporate Governance Committee.

PUBLIC SERVICE ENTERPRISE GROUP | 2013 Proxy Statement 15

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

The SEC and NYSE require compensation committees to assess the independence of their advisors and determine whether any conflicts of interest exist. In FebruaryJuly 2013, the O&CC reviewed CAPsCAP’s independence relative to the following factors: (i) CAP’s provision of other services to the Company; (ii) the amount of fees CAP receives from the Company as a percentage of CAP’s total revenue; (iii) the policies and procedures of CAP that are designed to prevent conflicts of interest; (iv) any business or personal relationship between O&CC members and CAP or its compensation consultants; (v) any PSEG stock owned by CAP or its compensation consultants; (vi) any business or personal relationship between our executive officers and CAP or any of its compensation consultants; and (vii) other factors that would be relevant to CAP’s independence from management. On the basis of such review, the O&CC concluded that CAP is independent and no conflicts of interest exist.

16 PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement

| CORPORATE GOVERNANCE |

In furtherance of CAP’s independence, management receives copies of certain materials provided by CAP to the O&CC only after the materials have been provided to the O&CC. The scope of CAP’s assignment is to provide general advice relating to all aspects of executive compensation, including the review of our current compensation programs and levels, benefit plans, provision of comparative industry trends and peer data and the recommendation of program and pay level changes.

We pay the fees of any compensation consultant retained by the O&CC. Additional information regarding any such services performed in the past year is included in the CD&A below. The O&CC also utilizes the services of our internal compensation professionals.

Compensation Committee Interlocks and Insider Participation

During 2012,2013, each of the following individuals served as a member of the O&CC: William V. Hickey, Shirley Ann Jackson, David Lilley, Thomas A. Renyi, and Richard J. Swift (Chair). During 2012,2013, no member of the O&CC was an officer or employee or a former officer or employee of any PSEG company. None of our officers served as a director of or on the compensation committee of any of the companies for which any of these individuals served as an officer. No member of the O&CC had a direct or indirect material interest in any transaction with us.

Standards of Integrity

Our Standards is a code of ethics applicable to us and our subsidiaries. The Standards:

|

|

|

|

The Standards are posted on our website,www.pseg.com/info/investors/governance/documents.jsp. We will send you a copy on request.

We will post on our website,www.pseg.com/info/investors/governance/documents.jsp:that website:

|

|

A waiver of any provision of the Standards may be granted in exceptional circumstances, but only for substantial cause. A waiver for any director or executive officer may be made only by the Board and, if granted, must be promptly disclosed to our stockholders. In 2012,2013, we did not grant any waivers to the Standards.

16 PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement

NOMINEES AND ELECTION

NOMINEES AND ELECTION

We regularly evaluateThe Corporate Governance Committee oversees our reporting practices to ensure that our disclosure appropriately meetspolitical activities and contributions in accordance with the needs of our shareholders. Accordingly, the Board recently approved a Corporate Political Participation Practice. This Practice which we have made publicly available on our website atwww.pseg.com/info/investors/governance/documents.jsp. In accordance with this Practice, we provide our stockholders with access to our reported state and federal political contributions. The Political Participation Practice also establishes a controls process, pursuant to which our senior management monitors, assesses, and approves certain political contributions. Our Board is responsible for generally overseeing our political participation activities and expenses. We believe this Political Participation Practice will allowallows us to minimize reputational and political risks and continue to focus on our operational excellenceexcellence. Stockholders may view our Practice atwww.pseg.com/info/investors/governance/documents.jsp. We also provide stockholders with access to our reported state and federal political contributions.

PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement 17

| NOMINEES AND ELECTION |

Transactions with Related Persons

There were no transactions during 2012,2013, and there are no transactions currently proposed, in which we were or are to be a participant and the amount involved exceeded $120,000 and in which any related person (director, nominee, executive officer or their immediate family members) had or will have a direct or indirect material interest.

Our policies and procedures with regard to transactions with related parties, including the review, approval or ratification of any such transactions, the standards applied and the responsibilities for application are set forth in our Principles, our Business Conduct Compliance Program (Compliance Program) and the Standards. These are our only written policies and procedures regarding the review, approval or ratification of transactions with related persons.

|

|

|

Our written management practices provide that any capital investment with a non-PSEG entity or its affiliate, for which one of our directors or officers serves as a director or executive officer, must be approved by our Board.

|

Directors elected at each annual meeting are elected to serve one-year terms. Directors whose terms are to expire are eligible for re-nomination and will be considered by the Corporate Governance Committee in accordance with its policies and the retirement policy for directors, which are summarized in this Proxy Statement. Each of the current directors has been nominated for re-election.

Our By-Laws currently provide that the Board shall consist of not less than three nor more than 16 directors as shall be fixed from time to time by the Board. The number of directors is currently setfixed at ten.

The nominees listed below were selected by the directors upon the recommendation of the Corporate Governance Committee. As discussed above under Annual Meeting, Voting and Procedures, proxies will be voted in accordance with your instructions as indicated on the enclosed proxy card, bank or broker voting card or when voting by telephone or Internet.

If at the time of the 20132014 Annual Meeting any of the nominees listed below should be unable to serve, which is not anticipated, it is the intention of the persons designated as proxies to vote, in their discretion, for other nominees, unless the number of directors constituting a full Board is reduced.

PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement 17

NOMINEES AND ELECTION

NOMINEES AND ELECTION

Majority Voting for Election of Directors

Our By-laws provide that in an uncontested election, each director shall be elected by a majority of the votes cast with respect to the director. A majority of votes cast means that the number of shares cast “for” a director’s election exceeds the number of votes cast “against” that director. We do not include as votes cast (i) shares which are marked withheld, (ii) abstentions and (iii) shares as to which a stockholder has given no authority or direction.

As provided in our Principles, the Board has adopted a policy whereby any incumbent director receiving a majority vote “against” must promptly tender an offer of resignation. As a result, in uncontested elections, the Board will nominate for election or re-election as a director only candidates who have agreed promptly to tender a letter of resignation in the event that the number of shares voted “for” that director

18 PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement

| NOMINEES AND ELECTION |

does not exceed the number of shares voted “against” that director. If an incumbent director fails to receive the required “majority” vote, the Corporate Governance Committee will consider the matter and then make a recommendation to the Board as to whether or not to accept the resignation. The Board will make the determination on whether or not to accept the recommendation of the Corporate Governance Committee.

The Principles further provide that no director who fails to receive a majority vote in an uncontested election shall participate in either the recommendation of the Corporate Governance Committee or the determination of the Board with respect to his or her resignation letter or that of any other director in regard to that year’s Annual Meeting election. Any such director may, however, participate in any and all other matters of the Board and its various committees to the fullest extent to which he or she would otherwise be permitted in accordance with applicable law and the Principles. If a majority of the Corporate Governance Committee fails to receive a majority vote, then the remaining independent directors will determine whether to accept one or more of the applicable resignations. If three or fewer independent directors diddo not receive a majority vote in the same election, then all independent directors may participate in any discussions or actions with respect to accepting or rejecting the resignation offers (except that no director will vote to accept or reject his or her own resignation offer).

In evaluating tendered resignations, the Corporate Governance Committee and the Board may consider all factors they deem relevant, including, but not limited to, the stated reason(s) for the “against” vote, the impact that the acceptance of the resignation would have upon our compliance with applicable law or regulation, the potential triggering of any change in control or similar provision in contracts, benefit plans or otherwise, the qualifications of the director and his or her past and anticipated future contributions to us.

The Corporate Governance Committee and the Board may consider possible remedies or actions to take in lieu of or in addition to acceptanceaccepting or rejectionrejecting of the resignation, such as development and implementation of a plan to address and cure the issues underlying the failure to receive a majority vote.

Following the Board’s determination, we will publicly disclose the decision and, ifas applicable, the reasons for accepting or rejecting the resignation. To the extent that the Board accepts one or more resignations, the Corporate Governance Committee may recommend to the Board, and the Board will then determine, whether to fill any vacancy.

Director Qualifications, Diversity and Retirement

The Board believes that a nominee for director should be selected on the basis of the individual’s ability, diversity of background and experience and soundness of judgment, from among candidates with an attained position of leadership in their field of endeavor. As noted above, a majority of the Board must consist of independent directors in accordance with our Principles and NYSE requirements.

The Board seeks to maintain an orderly transition for retirement and proper succession planning. Under the Board’s retirement policy, set forth in our Principles as revised in November 2013, directors who have never been employees of the PSEG group of companies may not serve as directors beyond the Annual Meeting of Stockholders held in the calendar year following their seventy-second birthday. If however, the Corporate Governance Committee and the Board determine that there is good cause to extend any such director’s Board service, he or she may be re-nominated following the age of seventy-two, but in no event beyond the age of seventy-five, and remain in service for the full term until the next Annual Meeting of Stockholders held in the calendar year following his or her seventy-fifth birthday. Mr. Gamper attained age 72 in March 2014. He is therefore eligible to serve until the 2015 Annual Meeting and has been re-nominated. Directors who are former PSEG CEOs may not serve as directors beyond the Annual Meeting of Stockholders following termination of active employment with the PSEG group of companies, unless otherwise determined by the Board, and may not serve beyond their seventy-second birthday. Directors who are former employees, other than CEOs, may not serve as directors beyond the Annual Meeting of Stockholders following termination of active employment with the PSEG group of companies.

In addition, it is the Board’s policy of the Board that a nominee recommended initially for election be able to serve at least five years, consistent with the Board’s retirement policy. The Board believes that the ability of a director to serve for at least five years is a reasonable expectation in order for us to receive an appropriate benefit from the individual’s abilities. This is especially so in light of the time invested by a director to become knowledgeable about our complex business operations. The Board believes that these age and service limitations provide it with a means for achieving a reasonable balance of veteran and new directors.

PUBLIC SERVICE ENTERPRISE GROUP l2014 Proxy Statement 19

| NOMINEES AND ELECTION |

18 PUBLIC SERVICE ENTERPRISE GROUP |2013 Proxy Statement

NOMINEES AND ELECTION

NOMINEES AND ELECTION

Diversity

Diversity is a factor for consideration of nominees for director pursuant to the diversity policy contained in our Principles and the charter of the Corporate Governance Committee. In considering diversity, the Corporate Governance Committee utilizes a broad meaning to include not only factors such as race, gender and national origin, but also background, experience, skills, accomplishments, financial expertise, professional interests, personal qualities and other traits desirable in achieving an appropriate group of qualified individuals. The Corporate Governance Committee considers and assesses the effectiveness of this policy in connection with the annual nomination process to assure it contains an effective mix of people to best further our long-term business interests.

The Corporate Governance Committee also considers the amount of time that a person will likely have to devote to his or her duties as a director, including non-PSEG responsibilities as an executive officer, board member or trustee of business or charitable institutions and the contributions by directors to our ongoing business. The Corporate Governance Committee considers the qualifications of incumbent directors and potential new nominees, as well as the continuity of service and the benefit of new ideas and perspectives, before making recommendations to the Board for election or re-election. The Board then selects nominees based on the Corporate Governance Committee’s recommendation.

The Corporate Governance Committee does not believe it is appropriate to set absolute term limits on the length of a director’s term. Directors who have served on the Board for an extended period of time are able to provide valuable insight into the operations and future of the Company based on their experience with and understanding of our history, policies and objectives.

Prior to accepting an invitation to serve as a director of another public company, the CEO and any directors must submit a letter to the Corporate Governance Committee so as to allow it to review potential conflicts and time demands of the new directorship. Any director who undertakes or assumes a new principal occupation, position or responsibility from that which he or she held when he or she was elected to the Board must submit a letter to the Corporate Governance Committee volunteering to resign from the Board. The Board does not believe that in every instance a director who undertakes or assumes a new occupation, position or responsibility from that which he or she held when the director joined the Board should necessarily leave the Board. The Corporate Governance Committee reviews the relevant details of such director’s new position and determines the continued appropriateness of Board membership under the circumstances.

Nominees and Nomination Process

The present terms of all ten directors,Albert R. Gamper, Jr., William V. Hickey, Ralph Izzo, Shirley Ann Jackson, David Lilley, Thomas A. Renyi, Hak Cheol Shin, Richard J. Swift, Susan Tomasky andAlfred W. Zollar, expire at the 20132014 Annual Meeting. Each director has been re-nominated. Each will be presented for election to serve until the 20142015 Annual Meeting, or until theirhis or her respective successors aresuccessor is elected and qualified. All nominees except Mr. Zollar, who was elected as a director by the Board in June 2012, were elected to their present terms by our stockholders.

Conrad Harper retired from the Board effective December 31, 2012. Mr. Harper had served on the Board since 1997. The members of the Board wish to thank Mr. Harper and express the Board’s sincere appreciation for his many years of dedicated service to our Company.

The Corporate Governance Committee on occasion may pay a fee to an executive search firm to assist it in identifying and evaluating potential director nominees meeting our criteria, which are described further below.above. Any such firm’s function would be to assist the Committee in identifying potential candidates for its consideration. During 2012,2013, we engageddid not engage a third-party firm to conduct a search for potential candidates. Mr. Zollar was identified to us in this process.